Tender MR 232/2020 Review of the Accounting Depreciation Rates for Energy Fiji Limited

ENERGY FIJI LIMITED FORMERLY KNOWN AS FIJI ELECTRICITY AUTHORITY

TENDER No. MR 232 / 2020

Review of the Accounting Depreciation Rates for Energy Fiji Limited

The Energy Fiji Limited formerly known as Fiji Electricity Authority. A Statutory Corporation established by The Electricity Act Cap 180, hereby Invites Interested Bidders, (Accounting Firms, Energy Asset Depreciation Experts/Consultants) to Review the Accounting Depreciation Rates of Energy Fiji Limited’s Fixed Asset Register.

The accounting depreciation rates that is currently applicable was last reviewed in 2004 and has been adopted by EFL since then which was approved by the EFL Board.

Scope

- Review the current accounting depreciation rates that EFL will use to measure the accounting life of its Property, Plant and Equipment. Make sure that any proposed change in accounting depreciation rate is supported by similar industries and is relevant.

- Review and recommend to EFL the depreciation rates that should be applicable to the asset types that are still being used by EFL despite the Assets Written Down Value is Zero.

- Review the depreciation rates that should be applicable to EFL’s Specialised Assets such as:

- Hydro Assets – dams

- Hydro Assets – tunnels

- Hydro Assets – Plant & Machinery

- Solar Farm

- Wind mill

- Radiator Upgrade

- Containerized Diesel Generator Sets

- Transformers & Protection Upgrade

- Switchgears, Battery Banks & charger

- Underground Cabling

- Specialized Vehicles & Equipment’s

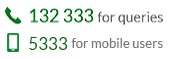

This tender closes at 4.00pm (16.00hrs Fiji time) on Wednesday 28th October, 2020. Please contact our commercial department at EFL Head office on phone 3224360/9992400 for the tender specification or email – Tenders@efl.com.fj

For Tender Details visit EFL’s website – www.efl.com.fj and https://www.tenderlink.com.fj

Property, plant and equipment

Property, plant and equipment are measured at cost less accumulated depreciation and impairment loss. Cost includes expenditure that is directly attributable to the acquisition of the item. Cost of leasehold land includes initial premium payment or price paid to acquire leasehold land including acquisition costs.

Additions

While expenditure on assets with a value of less than $300 is generally not capitalised, physical control is maintained over all items regardless of cost.

Depreciation rates

Depreciation is calculated using the straight line method to write off the cost of each asset over their estimated useful lives as follows:

Rates

Leasehold land 0.50% – 1.25%

Buildings – concrete 1.25%

Buildings – others 1.25%

Hydro Assets – dams 1.33% – 2.50%

Hydro Assets – tunnels 1.33% – 2.44%

Hydro Assets – plant and machinery 2.50% – 3.00%

Thermal assets 4.00% – 7.00%

Transmission 2.50%

Communication system and control 2.86%

Reticulation 4.00%

Wind mill 5.00%

Furniture and fittings 7.00% – 24.00%

Motor vehicles 20.00%

Computers 33.30%

Other fixed assets except for capital spares, are depreciated when they are brought into service.

Freehold land is not depreciated. Leasehold land is amortised over the remaining lease period.

Click here for Tender Submission.

Click here for Extension Notice.